Commodity Products

In economic terminology, a commodity is any economic good, normally a manufactured product, which has a substantial or complete fungibility: that is, that the marketplace treats cases of the commodity as essentially equivalent without regard to who created them. In monetary terms, commodities are money. Money, in turn, is a commodity. There are numerous types of commodities – Commodity futures, Commodity currencies, Commodity hedging, Commodity exchanges, and Commodity trading, just to name a few. The products that fall under these categories generally include: agricultural produce, livestock, meat and fish, petroleum, coal, iron ore, copper, aluminum, wheat, sugar, steel, transportation equipment, electrical equipment, toys, and services.

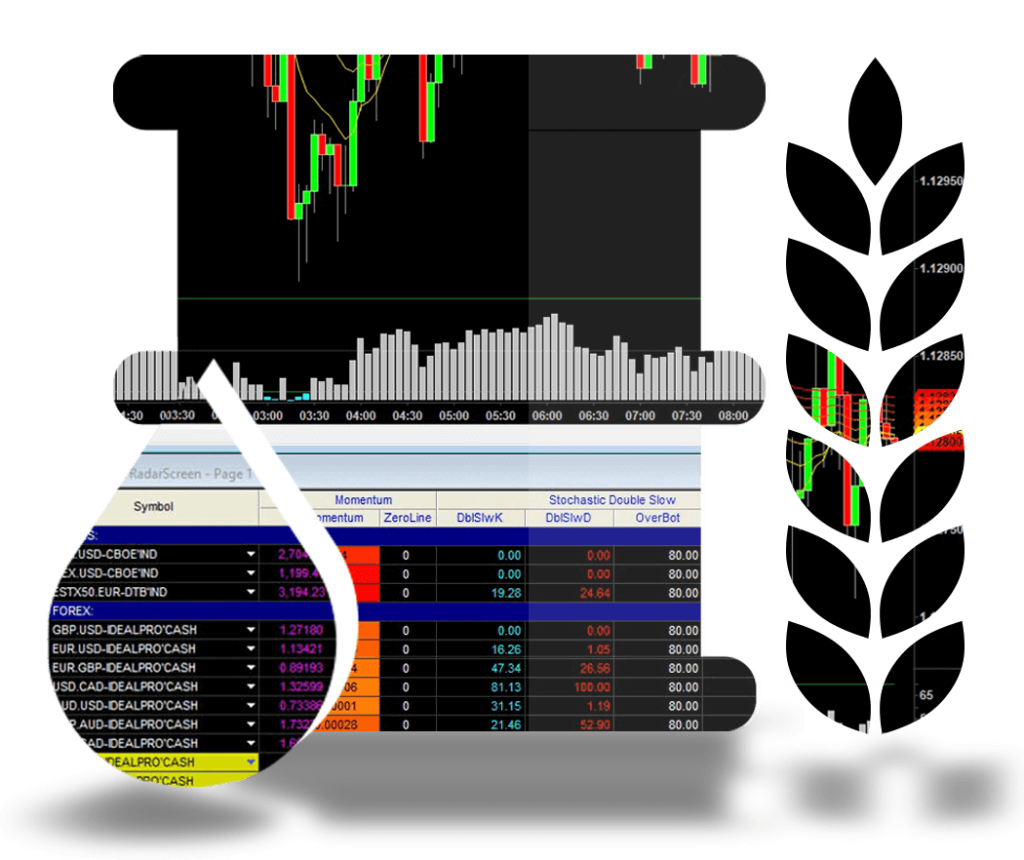

Traditionally, commodity markets were quite localized because local producers and distributors could meet demand by bartering or directly selling their products to consumers. However, over the last ten years, more commodities have been traded online due to increases in world trade and more efficient means of communication, such as the Internet. Now, even more specialized venues for trading commodities are being established, such as over the counter (OTC) commodities markets, electronic commodity trading, and over the counter derivatives.

Commodity trading, which has existed for centuries, has experienced a significant amount of growth and success in recent years, especially during the height of the Global Financial Recession, and as a result many new players have entered the playing field. Investors interested in commodity markets should consider commodities such as oil, gold, natural gas, silver, platinum, wheat, and pork bellies, as well as other industrial metals such as steel, aluminum, copper, zinc, and nickel. Commodity investments may also be made in agricultural commodities, such as dairy, hops, cotton, sugar, corn, and wheat. There are also special interest groups focusing on certain sectors of the Commodity Futures Trading market. An investment in commodity futures may offer the same high returns, security, and flexibility as other investments, however investors in the Commodity futures markets must exercise caution due to unpredictable market conditions.